Project Reporting in QuickBooks can help you understand which jobs are profitable and which ones are not. This information can be essential to grow your business.

Project Reporting in QuickBooks

Often people will add a new income and expense account for each new project. This may work for a few projects, but is not efficient once you start to grow.

Instead of adding more accounts to the List of Accounts, QuickBooks has several features specifically designed to track projects. Let’s look at one method using a simple example.

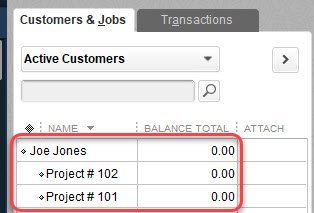

We setup new projects (Jobs) in the Customer List. Like this:

So, we have now added two new projects for Joe Jones. We are now able to track both Income and Expenses for each project. In the list above, Joe Jones is the customer and each project is a job.

Invoicing for a Job

When we create an invoice, we can select both the customer and the project (job). In our example below, we select the line that shows both Joe Jones and Project # 101.

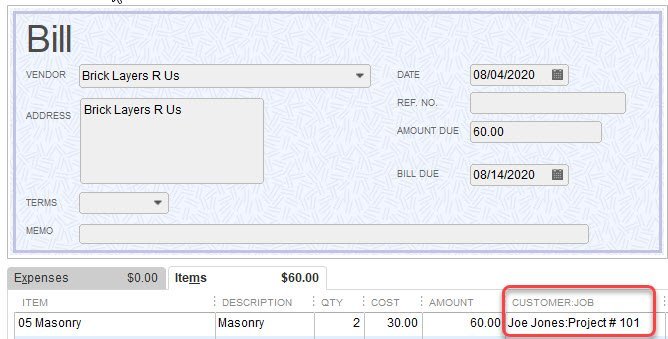

Entering Bills for a Job

When paying for project (job) related expenses, we actually use the Customer: Project name on the bill.

So in our example we have created an both and Invoice and a Bill for Project # 101. The invoice amount is $500 and the bill is $60. We can now see a report that shows both the invoice amount and expense amount for that project. QuickBooks has created an entire set of reports know as Project (Job) Reports. If you are using a desktop version of QuickBooks, select Reports > Jobs, Time & Mileage. Then select Job Profitability Summary. Here is the report for our project:

If we select the Job Profitability Detail report, we can see an item by item breakdown of income and expenses for each project. This can include labor and other costs. The detail report is often very long, but can easily be exported to Excel and provide very valuable information for your engineers. Because it can be exported to Excel, engineers do not need to have QuickBooks installed on their computer in order to review project information.

QuickBooks Online also offers some Job Cost Reporting capability. For example, Profit and Loss Reports can be filtered to show a project per column.

Locations, Divisions and More

Project Reporting in QuickBooks is more temporary in nature and usually has a start and finish date.

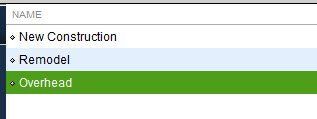

But what about a more permanent situation such as a store or office location, product line or division? There is a separate set of reports for this, and the setup is a little different. Locations, Divisions and Product Lines can be tracked using the Class List.

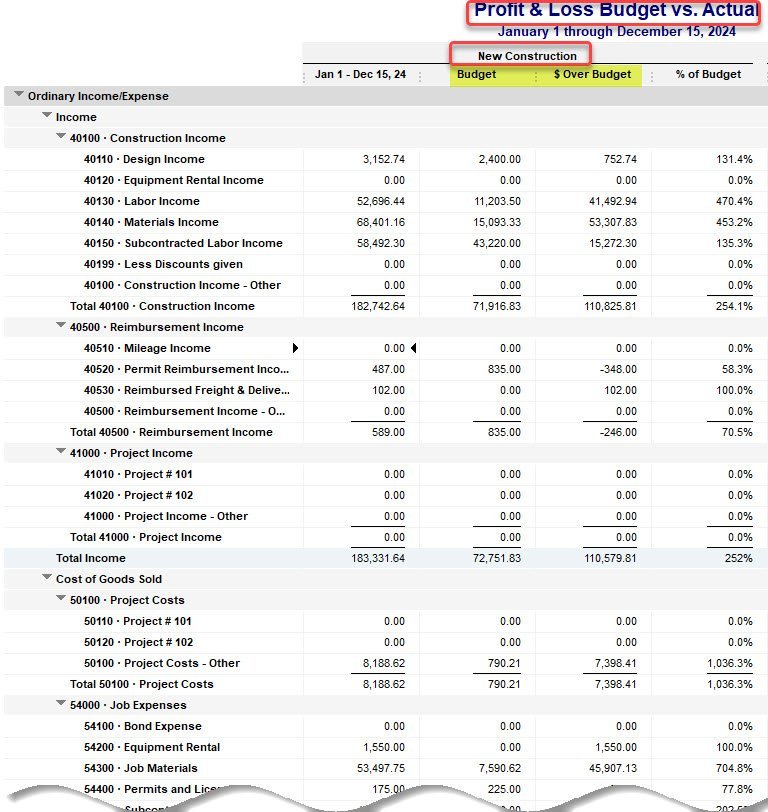

It is simply a list used to create the names of each location or other segment that we wish to track. Here is an example of a report for two divisions: New Construction and Remodel.

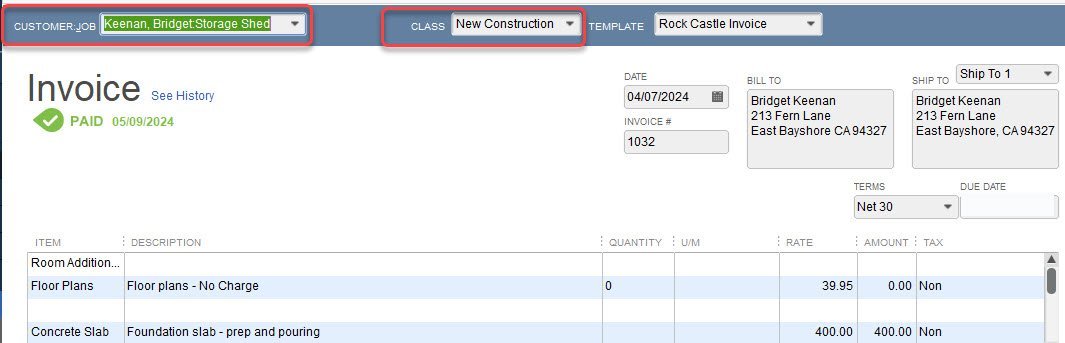

QuickBooks is very flexible and allow you to enter transactions using both Projects and Classes. Here is an example of an invoice with both Job and Class:

And here is a Bill with both Job and Class.

Location Reporting in QuickBooks Online

QuickBooks Online also offers reporting capabilities for reporting by Class / Location. These reports can be essential to analyzing your business operations.

Budget by Class and Project

There are many other reports available that can help you run your business. For example: QuickBooks allows you to create a budget for each Job and Class:

Below is an example of a Budget by Class Report. This feature will allow you to keep a separate budget for each division, store, location, product line or even partner in a law firm. A separate class can be created called “Overhead Expenses”. These overhead expenses can then be allocated to the other classes at the end of each month; thus, each class can be charged an “overhead burden”.

Profitability by Item Report

It is very important to monitor profit by item. While QuickBooks can show you markup and margin by item on the individual item setup screen (shown below), it is often useful to look at a report showing the actual profit for all items sold in a month. QuickBooks has a very useful Item Profitability Report. This show total revenue less cost for each item and service sold during a particular period of time.

Estimate Vs Actual Report

There are many ways to customize these reports and focus on the information that you need. Feel free to contact me with any questions.

About the Blogger

Tim Plue

I am an Advanced Certified QuickBooks ProAdvisor. I have taught QuickBooks and Bookkeeping classes for over 12 years. I enjoy helping Small Business Owners run their business with QuickBooks. I can help you wherever you are located!